Social innovations achieved through the digitalization represented by IoT are bringing major changes, not only to the finance sector, but also to all areas of society. The creation of new value in ways that transcend the boundaries between companies, industries, and business categories and the adaptation to the rapidly changing business environment will require a platform that is different from the IT systems used in the past. This article summarizes the requirements for this platform and describes Hitachi’s IoT Platform, Lumada, announced by Hitachi. It also presents examples of innovation in the industrial sector and mentions advances in the fusion of finance and industry through digitalization. Finally, this article looks into the opportunities for improving the accuracy of risk assessment, controlling loss costs, and creating new services in collaboration with other industries that are made possible by applying this platform in the finance sector.

Lumada SoE Project Center, IoT & Cloud Services Business Division, Service Platform Business Division Group, Information & Communication Technology Business Division, Hitachi, Ltd. (as of September 2016) He is currently engaged in the planning of service platform businesses. Mr. Takahara is a member of the Information Processing Society of Japan (IPSJ).

Strategic Planning Division, Services & Platforms Business Unit, Hitachi, Ltd. He is currently engaged in the planning of platform business strategies. Mr. Kohinata is a member of the Institute of Electronics, Information and Communication Engineers (IEICE).

Service Business Development Center, Service Businesses Division, Service Strategy Division, Social Innovation Business Division, Hitachi, Ltd. He is currently engaged in the development of service businesses through collaborative creation with customers.

Business Planning Unit, Financial Information Systems Sales Management Division, Financial Institutions Business Unit, Hitachi, Ltd. He is currently engaged in business planning for the financial industry.

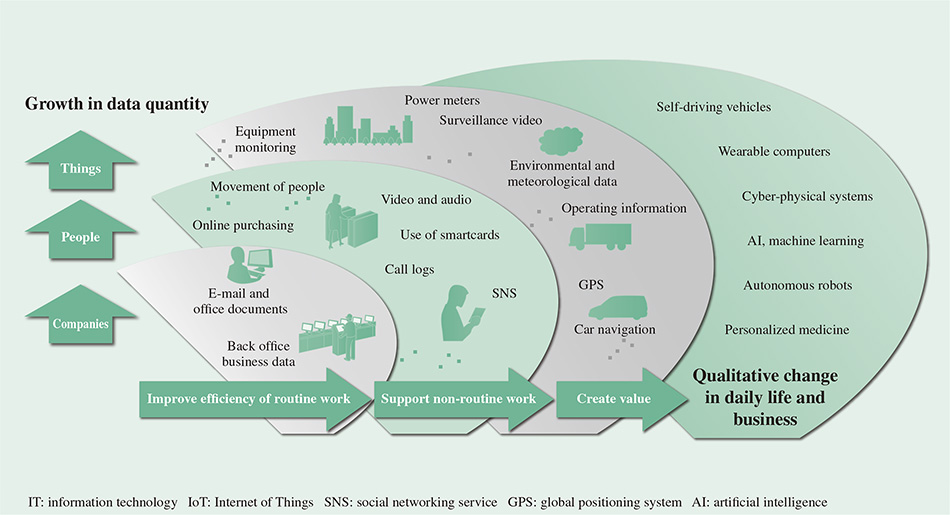

FROM their first appearance in the 2nd half of the 20th century, computers were used to process business data in offices. With the emergence of the Internet, the scope of information technology (IT) expanded to include non-routine work as it became a means to encourage connections between people through tools like e-mail and social networking services (SNSs). Recent years have also seen the marked spread of the Internet of Things (IoT) and the connected car, referring to the connection of devices and vehicles, respectively, to the Internet, with the network-connected things themselves transmitting and receiving information. As the number of target devices increases, explosive growth is taking place in the quantity and diversity of the information they produce (see Fig. 1).

The digital innovations brought about by this digitalization of the whole society have been characterized, among other things, as representing a fourth industrial revolution (Industrie 4.0*1) and a new type of society (Society 5.0*2).

Fig. 1—Expansion in Applications for IT and Growth in Data.

The quantity of data to be processed is increasing rapidly due to the growth in quantity and diversity of data generated by devices as a result of the IoT and the expanding scope of IT.

The quantity of data to be processed is increasing rapidly due to the growth in quantity and diversity of data generated by devices as a result of the IoT and the expanding scope of IT.

The finance sector has been quick to make use of IT in business, including by shifting accounting systems online. Financial institutions have developed over time by continually adopting sophisticated IT innovations, such as Internet banking, risk calculations for complex financial products driven by financial engineering, and high-frequency trading (HFT).

With the arrival of this new era of digital innovation, financial institutions with involvement in the IT industry faced the following new challenges to the continued provision of sophisticated services in the future.

The format of IT is also progressively changing in response to the wave of innovation created by digital technology.

Originally, the most common model used by financial institutions for providing services was to retain their own IT. Under this model, IT vendors participated in the system development of financial institutions as system integrators.

Subsequently, a new approach to using IT has emerged wherein a number of financial institutions develop and operate systems jointly with the aim of reducing costs as systems become larger and practices become more complex. Accordingly, the idea of shared economy, where a number of businesses share an IT platform to reduce the cost of development and maintenance, has been incorporated into system platforms.

Cloud computing has transformed IT by taking this idea further and making applications and platforms available as services. The jointly operated data centers of regional banks were among the early adoptions of this model.

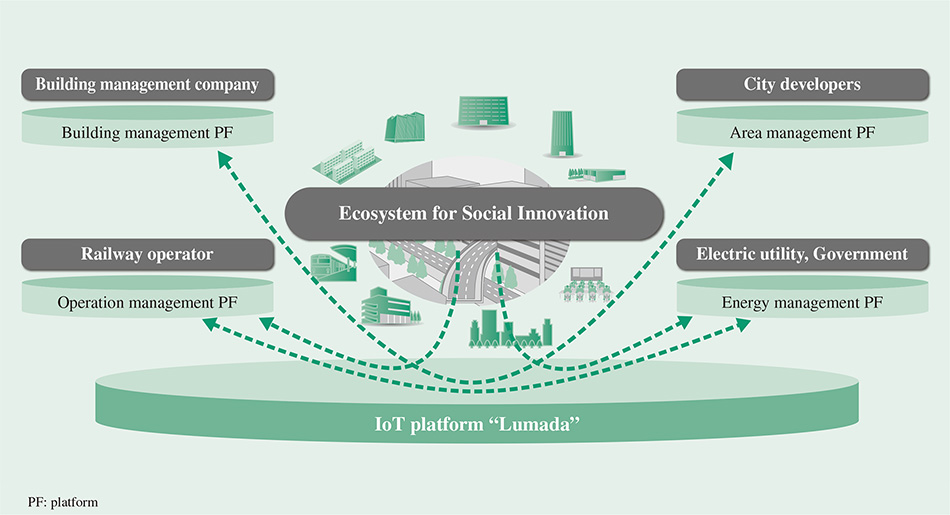

Future digital innovation will involve a frequent exchange of data and services across different industries and business categories. Rather than the past practice of sharing services and other resources across a limited range of industries, a requirement of new platforms will be the establishment of ecosystems that span multiple industries and business categories (see Fig. 2).

Fig. 2—Platform that Provides an Ecosystem for Innovation.

Progress in digital innovation is enabling the exchange of data and services across different industries and business categories, creating a need for platforms that can provide an ecosystem for innovation.

Progress in digital innovation is enabling the exchange of data and services across different industries and business categories, creating a need for platforms that can provide an ecosystem for innovation.

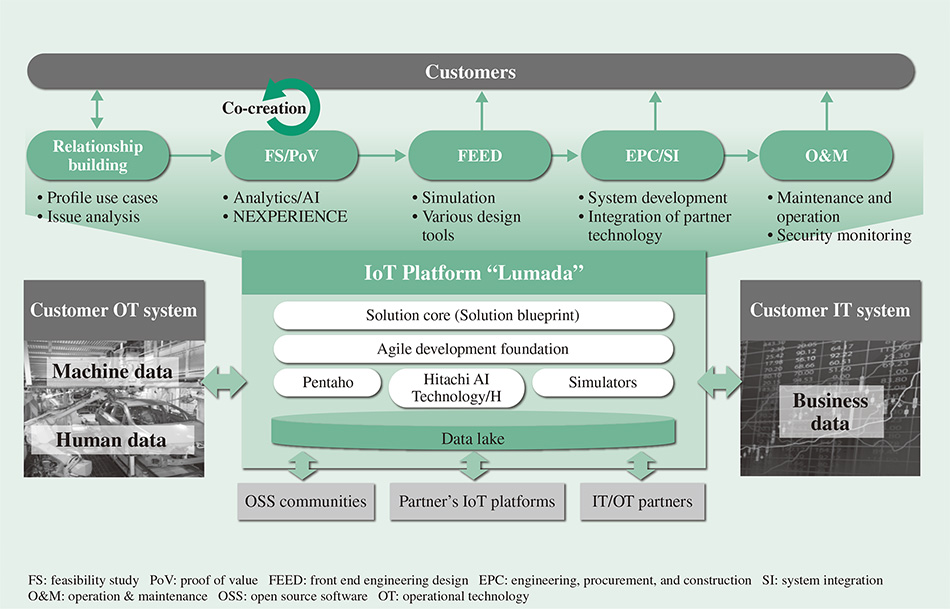

Based on the above considerations, in May 2016 Hitachi announced its IoT platform, “Lumada” as a new platform to overcome these challenges.

Hitachi has a product range that includes power generation, railway, and medical devices, and an extensive portfolio of operational technologies (OT) for controlling and operating these products. It also has extensive experience from its participation in the IT industry, dating back to the early days of computing. Lumada consolidates Hitachi's advantage of possessing both OT and IT. The Lumada platform supports not only the IoT, but also all aspects of digital innovation.

Fig. 3—Processes and Components for Agile Collaborative Creation using Lumada.

Lumada provides agility from early verification of potential innovations to implementation.

Lumada provides agility from early verification of potential innovations to implementation.

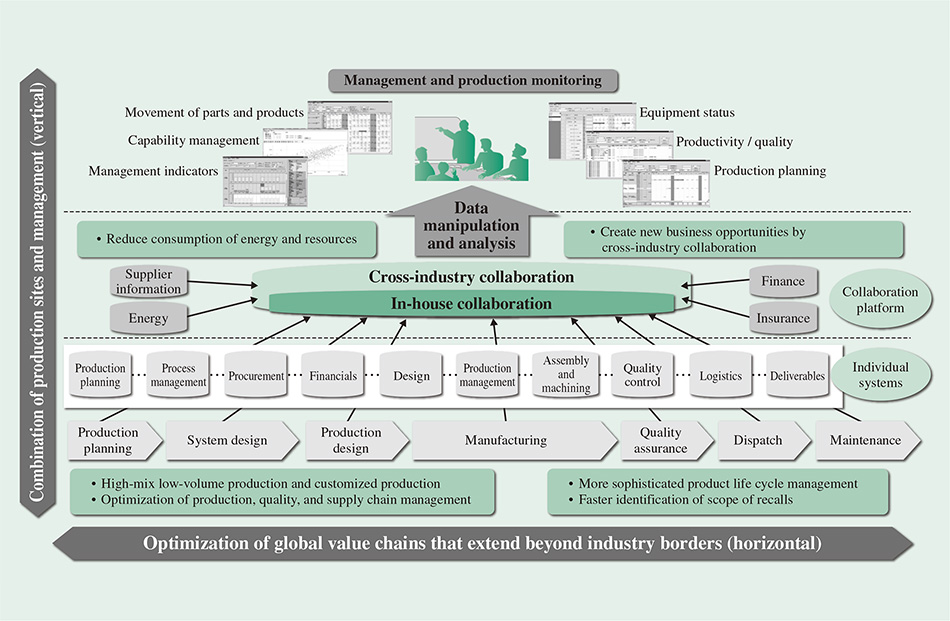

Hitachi uses Lumada, which has these features, as a basis for supplying solutions that improve energy efficiency, productivity, asset utilization, and the convenience of data exchange to a variety of business sectors, including industry, social infrastructure, and healthcare. In the case of industry, for example, the trend toward digital innovations as represented by Industrie 4.0 is bringing significant changes to the competitive requirements of manufacturers. Hitachi is combining OT and IT in the manufacturing industry to organize and enhance platforms that can coordinate different companies across multiple sectors, in what it calls the “optimized factory.”

There is a strong requirement for manufacturing companies to transcend the boundaries between industries and to optimize value chains globally by combining production sites and management (see Fig. 4).

For manufacturers that operate a number of sites around the world to perform accurate planning at a global level, they must be able to make accurate and timely assessments of information about production, sales, and inventory that is maintained individually at each site. This involves using IoT, big data, artificial intelligence (AI), and other forms of IT to collate and analyze workplace data on the activities of people, goods, and equipment, including procurement (of materials and parts), assembly (of semi-finished and finished products), quality control, and equipment operation, and to make immediate use of it in the workplace. It also involves analyzing the collected data and using it to make ongoing operational improvements.

Furthermore, Hitachi believes that the development of optimized manufacturing and management across the entire value chain [including procurement, assembly, logistics, and improving the cash conversion cycle (CCC) in coordination with financial institutions] is the next stage in improving business relations. Also transcending the boundaries between individual organizations to coordinate activities of those companies that make up a value chain and utilizing the big data this generates mean we can respond quickly to fluctuating demands and changes in the supply of materials.

Fig. 4—Collaborative Creation Platform that Optimizes Manufacturer Value Chains.

The diagram shows the architecture of a service for optimizing manufacturer value chains through the coordination of data both inside and outside the company.

The diagram shows the architecture of a service for optimizing manufacturer value chains through the coordination of data both inside and outside the company.

How will financial institutions use this digital innovation platform to achieve financial innovation?

In the finance sector, digitalization has been adopted for many product services, such as deposits, transfers, securities, and financial markets, and also for the prerequisites of these services. While there remain cases that involve handling physical items such as cash, there is no need for “things” in product development and production.

While there are limited opportunities for the finance industry to adopt IoT for their business innovation, various innovations in financial products and services will be possible once the targets of financial service are digitalized, and data from the targets is collected and available to financial firms to make the status of their targets visible.

It is anticipated that the ability to collect and use big data to provide financial services through the adoption of the IoT will open up significant possibilities for innovation in those services. This means that financial institutions will need to form partnerships with the companies that use their services. Moreover, this will likely lead to financial institutions working on the platform and becoming part of business ecosystems, to develop and deliver appropriate and attractive financial services. Also important will be timely compliance with legal frameworks, regulations, and commercial practices.

In addition to making extensive use of its IoT platform “Lumada” in the industrial and public sectors, Hitachi will also strive to rapidly develop and deliver better services by utilizing the big data collected as a result of this and the associated know-how.

Based on the extensive technologies and knowledge of big data analytics that Hitachi has acquired in industry, it will engage in collaborative creation with financial institutions to determine how different sorts of data can be used in the development of financial products and services.

Hitachi also intends to work with financial institutions on creating the business ecosystems for achieving this.