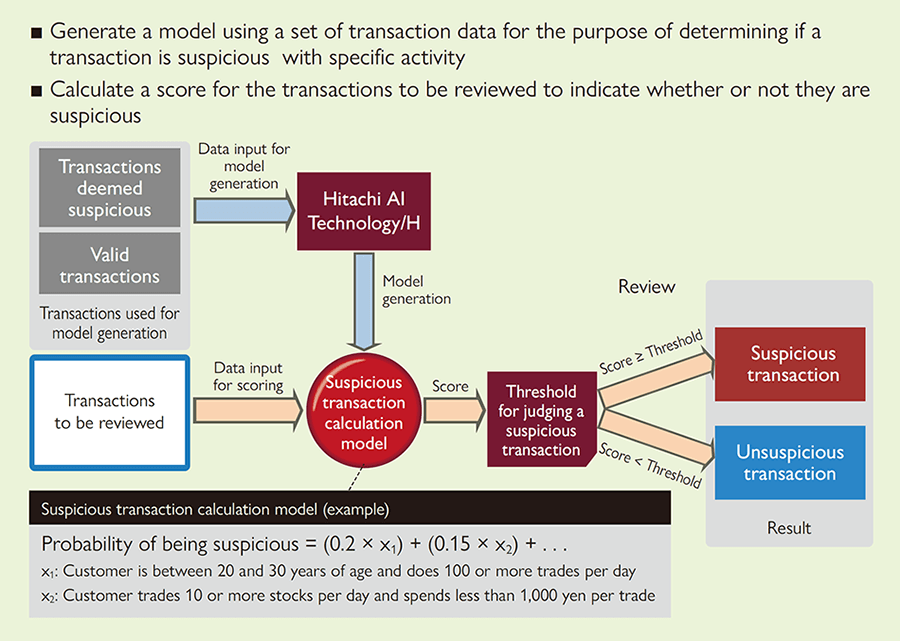

1. Applying AI to Identifying Suspicious Transactions in Securities Firms and Exchanges

The securities industry is making growing use of artificial intelligence (AI) for tasks such as the automated trading of stocks and bonds, decisions about opening accounts, or giving credit for loans.

As part of this trend, Hitachi AI Technology/H (Hereafter referred to as AT/H) is being deployed in the reviewing of stock trades, a job that in the past required a specialist, where it is being used in place of such specialists to screen trades for possible suspicious activity. Past trading data, the results of reviewing trades, and market data, all of which were pre-processed based on the knowledge of the specialists and were supplied to AT/H to generate a model that quantifies risk assessments that are close to what the specialists had done. The aim is to improve efficiency by feeding transaction data into this model so that it can produce risk assessments similar to those determined by the specialists and reduce the number of trades that ultimately need to be checked by a person(specialist). As of September 2018, this solution had been adopted by a number of companies.

Along with enhancing the AT/H model by expanding its scope of application to cover a larger number of types of suspicious transactions, future plans also include expanding its scope of application to cover other financial products than stocks as well as all other types of commercial transaction activity.